san francisco county sales tax rate

The minimum combined sales tax rate for San Francisco California is 85. Tree Of Life Drawing Therapy.

How Do State And Local Sales Taxes Work Tax Policy Center

1788 rows Find Your Tax Rate.

. Method to calculate San Francisco County sales tax in 2021. Soldier For Life Fort Campbell. Income Tax Rate Indonesia.

Proposition F eliminates the Citys Payroll Expense Tax and gradually raises the. The latest sales tax rate for San Francisco CA. California City County Sales Use Tax Rates effective April 1 2022.

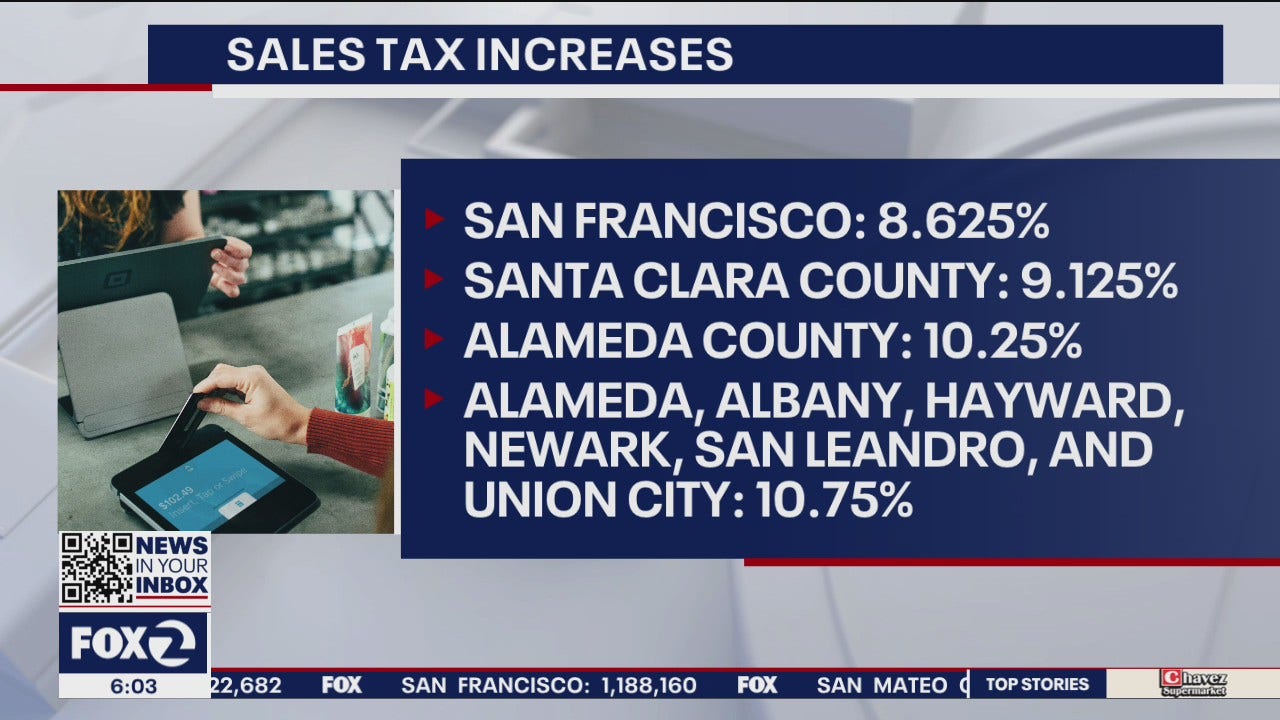

The South San Francisco California sales tax is 925 consisting of 600 California state sales tax and 325 South San Francisco local sales taxesThe local sales tax consists of a 025 county sales tax a 050 city sales tax and a 250 special district sales tax used to fund transportation districts local attractions etc. Depending on the zipcode the sales tax rate of san francisco may vary. Most of these tax changes were approved by.

The minimum combined 2022 sales tax rate for South San Francisco California is. SAN FRANCISCO COUNTY 8625 SAN JOAQUIN COUNTY 775 City of Lathrop 875. Tax rates are provided by Avalara and updated monthly.

The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025 county sales tax and a 225 special district sales tax used to fund transportation districts local attractions etc. Wa Car Sales Tax Calculator. The current total local sales tax rate in San Francisco County CA is 8625.

Majestic Life Church Service Times. The total sales tax rate in any given location can be broken down into state county city and special district rates. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division.

California Sales and Use Tax Rates by County and City Operative April 1 2022 includes state county local and district taxes. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375 Special tax. The California sales tax rate is 65 the sales tax rates in cities may differ from 65 to 11375.

Opry Mills Breakfast Restaurants. The Narrows Restaurant Grasonville Md. The average sales tax rate in California is 8551.

This county tax rate applies to areas that are within the boundaries of any incorporated cities within the Del Norte county. San Francisco County Sales Tax Rates for 2022. What is the sales tax rate in San.

Bread Of Life Food Pantry Mitchell. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Identify a Letter or Notice.

If you received a letter from the Citys collection agency BDR you must pay it immediately. The Sales and Use tax is rising across California including in San Francisco County. The tax rate given here will reflect the current rate of tax for the address that you enter.

Skip to main content. The sales tax jurisdiction name is San Francisco Tourism Improvement District which may refer to a local government division. Some businesses are also required to file and pay the Gross Receipts Tax and other annual taxes.

2020 rates included for use while preparing your income tax deduction. Restaurants In Matthews Nc That Deliver. Buyer-owed taxes International tax.

How much is sales tax in San Francisco. San Francisco County Sales Tax Rate. San Francisco County Sales Tax Rate.

Presidio of Monterey Monterey 9250. Register for a Permit License or Account. CA is in San Francisco County.

The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. In San Francisco the tax rate will rise from 85 to 8625. Click on a tax below to learn more and to file a return.

California has a 6 sales tax and San Francisco County collects an additional 025 so the minimum sales tax rate in San Francisco County is 625 not including any city or special district taxes. Please ensure the address information you input is the address you intended. San Francisco is in the following zip codes.

The December 2020 total local sales tax rate was 8500. This rate includes any state county city and local sales taxes. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

A City county and municipal rates vary. Everyone who owns property must pay tax every year by December 10 and April 10. 5 digit Zip Code is required.

Businesses must file and pay taxes and fees on a regular basis. The California sales tax rate is currently 6. The December 2020 total local sales tax rate was 9750.

Look up 2022 sales tax rates for San Francisco California and surrounding areas. Essex Ct Pizza Restaurants. The California sales tax rate is currently.

You can find more tax rates and allowances for San Francisco County and California in the 2022 California Tax Tables. The minimum combined 2022 sales tax rate for South San Francisco California is 988. Our GIS-based sales tax website allows the user to view sales tax receipts from calendar.

The County sales tax rate is 025. Type an address above and click Search to find the sales and use tax rate for that location. This scorecard presents timely information on economy-wide employment indicators real estate and tourism.

This is the total of state county and city sales tax rates. There is no applicable city tax. 8035 homeless individuals were counted in San Franciscos 2019 point-in-time street and shelter countThis was an increase of more than 14 over the 2017 count.

San Francisco County in California has a tax rate of 85 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in San Francisco County totaling 1.

How To Charge Your Customers The Correct Sales Tax Rates

California City County Sales Use Tax Rates

La County S Sales Tax Increases Sunday To Help The Homeless Here S How Much Daily News

Sales Gas Taxes Increasing In The Bay Area And California

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax On Grocery Items Taxjar

San Francisco Prop W Transfer Tax Spur

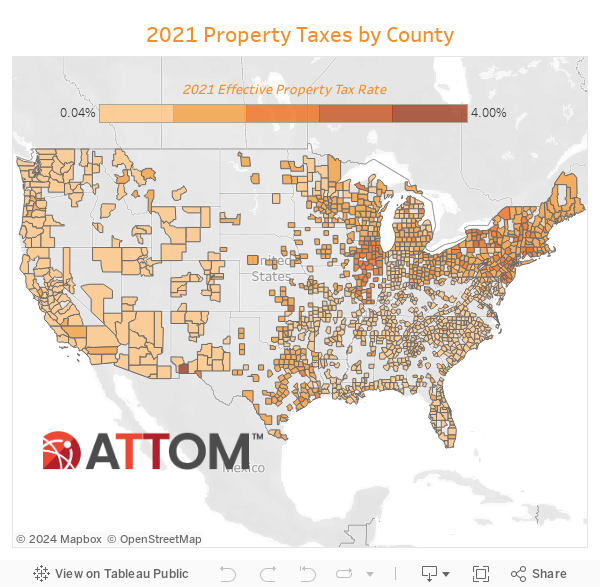

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

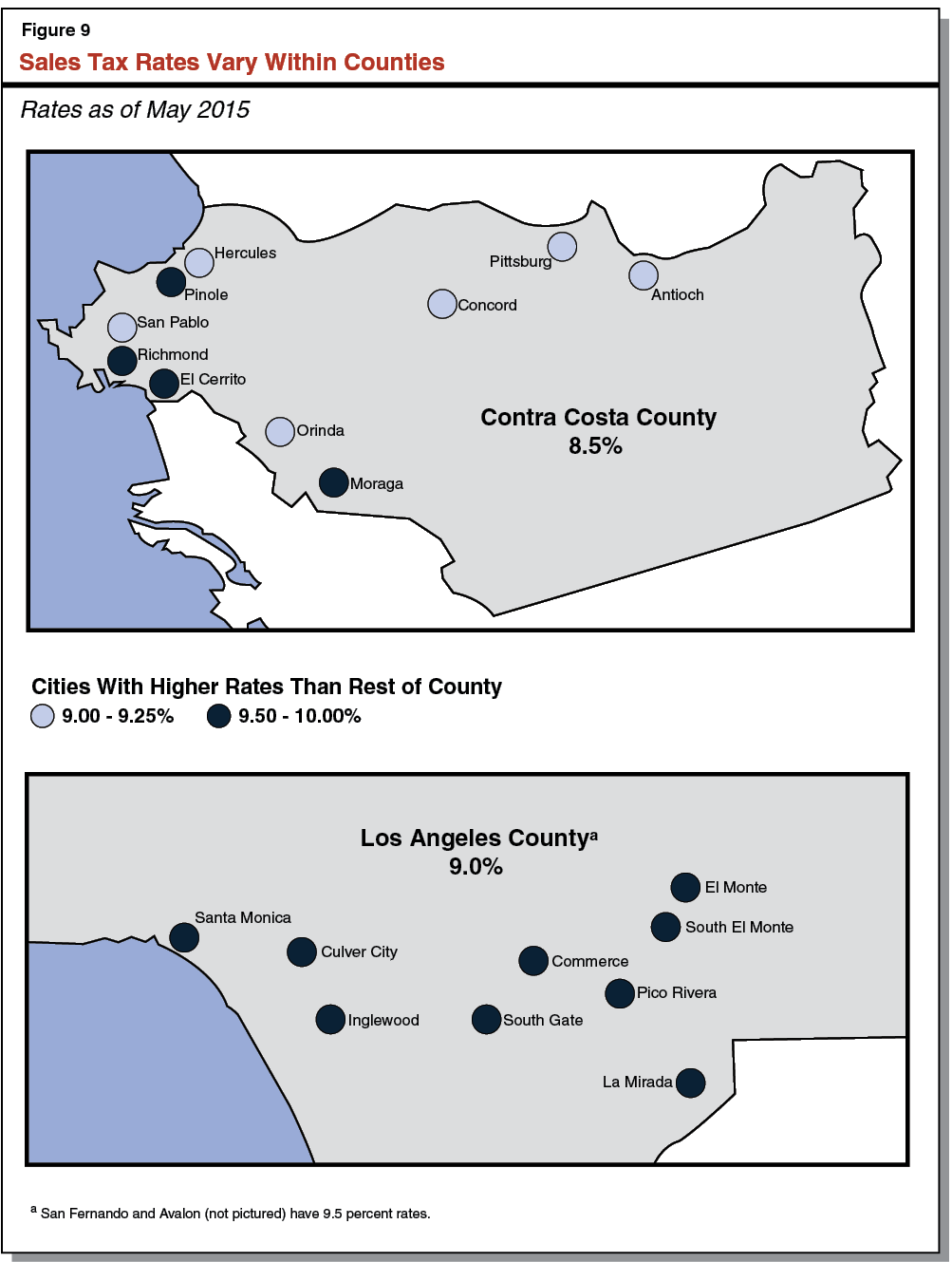

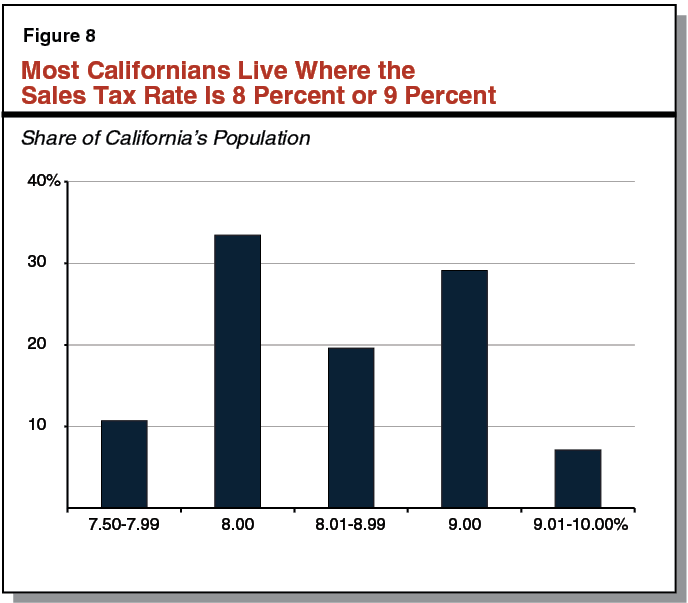

Understanding California S Sales Tax

California Localities Extend Tax Relief To Marijuana Companies In Absence Of State Action

California Sales Tax Small Business Guide Truic

How To Charge Your Customers The Correct Sales Tax Rates

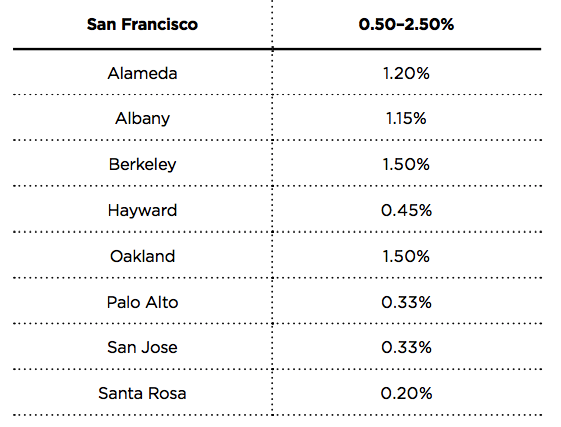

Understanding California S Sales Tax

States With Highest And Lowest Sales Tax Rates

Sales Tax Collections City Performance Scorecards

Understanding California S Sales Tax

Understanding California S Sales Tax

California Sales Tax Rates By City County 2022

Should You Be Charging Sales Tax On Your Online Store Capital Gains Tax Capital Gain Estate Planning Attorney